- Graham's Gazette

- Posts

- #81 - Before We Turn the 2025 Page

#81 - Before We Turn the 2025 Page

More Years & More Lessons

Another year in the books and hard to believe that we are already more than halfway through the 2020s. I’ll spare you my theory on why I think time accelerates as you age but it is truly amazing to me how far removed we are already from the COVID era and for all of us another year removed from our childhood. When I look back on the past year there are many lessons learned and below are the top notes I wrote down to myself in 2025 that still stand out to me as we turn the chapter for 2026.

Consistency is a superpower and a blind spot. Consistency builds everything you have. It’s also the trait that keeps you enduring conditions longer than you should. You don’t burn out loudly. You grind quietly until the urge to disappear shows up.

Competence quietly becomes obligation if you’re not careful. When you’re reliable, capable, and consistent, the world naturally leans on you out of convenience. What once earned trust turns into expectation, and responsibility is assumed rather than chosen. The mistake isn’t being capable, it’s forgetting that competence should create optionality, not permanent load. Just because you can carry something doesn’t mean it belongs to you.

Starting small today will always beat starting big later. No one is thinking about you as much as you do. You’re more disciplined than you think. You’re more lazy than you think. Stop overestimating your downside. Stop underestimating your upside.

You are never in the clear from making bad decisions that can impact your life poorly. Stay alert and guard the good. Embrace virtues over vices.

If you focus too much on the things you don’t have and sacrifice what you have to get it. Eventually you will get what you want, but risk losing everything that you had and wanted it for to begin with.

If you play victim to your situation your situation will never change.

Gratitude and happiness is something you exercise, not something you innately have.

Go to bed early and wake up early. Nothing good ever happens after midnight.

Go for walks and leave the AirPods at home. You need to detach from screens and noise.

You are the architect of your limited time. Draw it wisely and create systems to gain more free time.

Freedom Fund Recap

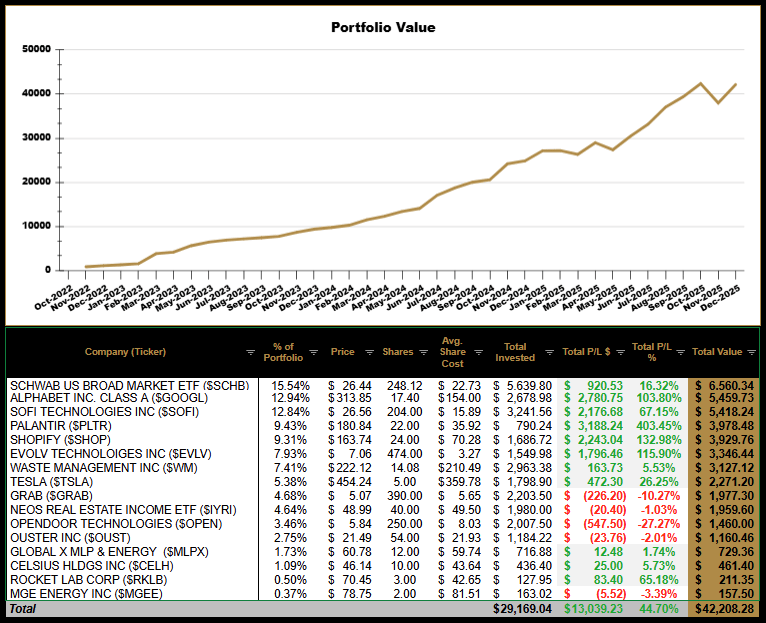

On January 1st, 2025 the Freedom Fund sat at $24,848.78 in its 27th month since inception. In its 39th month the account now totals $42,208.28. My strategy has not changed in terms of contributions. $200 a week every week contributed towards building an account that will give me flexibility later in life. This fund has taught me that you can build momentum quietly.

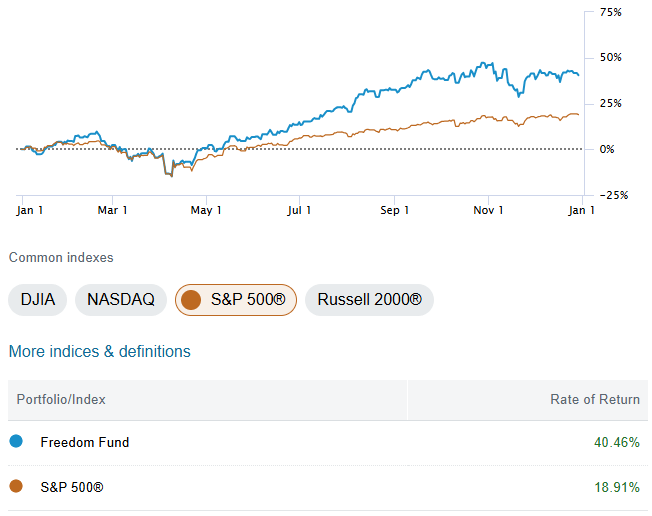

My rate of return year to date came out to just over 40% over doubling the returns of the S&P 500. These were largely driven by some winners I am holding still in $GOOGL ( ▲ 1.04% ), $SOFI ( ▲ 1.69% ), $PLTR ( ▲ 3.91% ), and $SHOP ( ▲ 9.71% ). As these holdings carry a heavy weight in the portfolio I will continue to balance out in other positions in 2026 and let these winners run unless something fundamentally changes with their businesses. Obviously, the goal is to beat the indexes every year but I am realistic with myself that this I had some positions that just had great runs.

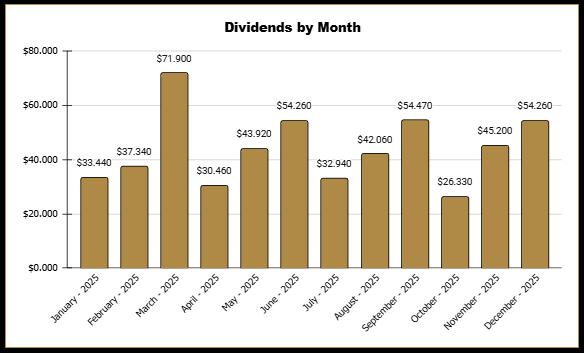

This year I reinvested $526.58 of dividend income back into the portfolio. While this accounts focus is more on growth for the time being I still know dividends are important to overall portfolio growth. I will continue to build out my income positions within the Freedom Fund next year.

My Goals for 2026:

Hit the $75,000 mark. With adding $200 per week again that would require another 40% return next year to hit the mark. This is a very steep and maybe unrealistic goal but I am hoping that I can position myself to get there by year end. By end of 2027 my goal is to hit the $100k mark.

Balance out the portfolio where $SCHB ( ▲ 0.84% ) is at minimum 25% of the portfolio.

Average $75 per month in dividend income (obtainable just need to get $372 more next year).

Grow account to 20-25 holdings and diversify into more market sectors (currently at 16). Ideally longer term I would like any single stock to be no more than 5% of the total portfolio.

Freedom Fund Background: I launched the Freedom Fund in October 2022 as a public brokerage account to show that anyone—with just a bank account and Social Security number—can start investing, even with a couple hundred dollars a week. I started from $0 to make the journey real and relatable. Each week, I share transparent updates on purchases, sales, dividends, and growth on X (@GrahamSchroeder) so you can follow along in real time. The hardest part of investing is getting started—so I did, publicly, to help others do the same.

The purpose of this newsletter is to encourage you and our other 94 Gazette subscribers to start and stay consistent with your personal, professional, and financial journey.

Thanks for investing your time reading this.

-Graham (@GrahamInvesting)

Disclaimer: Graham’s Gazette provides information and resources related to investing, financial topics, and personal growth for educational and entertainment purposes only. The content presented is not intended to be construed as financial advice. Readers are encouraged to conduct their own research and consult with qualified professionals before making any financial decisions. Graham’s Gazette and its creators do not assume any responsibility for the accuracy or completeness of the information provided nor do they guarantee any specific results from such use of information.