- Graham's Gazette

- Posts

- #70 - Drop the Anchor

#70 - Drop the Anchor

Quote of the Week

When you get caught in the mix of work, routine, and the quiet solitude that modern life often brings, it’s easy to forget to pause. The grind becomes the norm. The pace becomes expected. But even the strongest ships need to drop anchor.

It’s important to rest when you can. Your sails need mending. Find your harbor. Step away from the waves. Take that day.

Harbors give you what you need to keep going when you know you have more water to navigate.

Pause but don’t unpack. Refuel but don’t forget the map. It’s okay to take a break from the headwind. Just don’t forget you’ve still got somewhere to sail.

SOC 2 in 19 Days using AI Agents

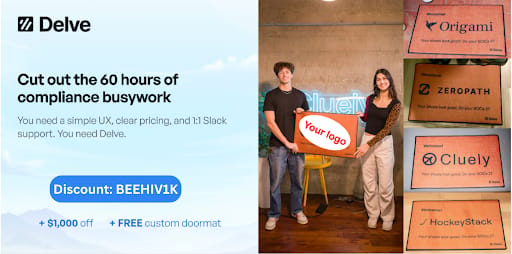

We’re Delve — the team that went viral for sending custom doormats to over 100 fast-growing startups.

That stunt? It cost us just $6K and generated over $500K in pipeline. Not bad for a doormat.

But if you haven’t heard of us yet, here’s what we actually do: Delve helps the fastest-growing AI companies automate their compliance — think SOC 2, HIPAA, ISO 27001, and more — in just 15 hours, not months.

Our AI agents collect evidence, generate policies, and prep everything while you keep building. And when it’s time to close your enterprise deal? Our security experts hop on the sales call with you.

We’ve helped companies like Lovable, Bland, Wispr, and Flow get compliant and grow faster — and we’d love to help you, too.

Market & Freedom Fund Recap

The market generally stayed strong this week with the Nasdaq hitting record highs and the S&P 500 holding near its peak. Bitcoin dropped about 4% today after hitting record highs in the $123k range. The big surprise came Thursday when the producer price index (PPI) jumped 0.9% in July (above 0.02% expectations MoM). This marked the biggest rise since 2022. The jump in PPI raised concerns that inflation could be heating up again. Hopes for a Federal Reserve interest rate cut in September cooled off Thursday, and markets reacted with a dip in stocks and higher bond yields. All eyes are back on Mr. Jerome Powell heading into the next Fed rates announcement.

The Freedom Fund moved up +4% from last week crossing the $36,000 mark for the first time ever. The increase in the portfolio was driven primarily from growth amongst my $SCHB ( ▲ 0.84% ), $EVLV ( ▼ 1.6% ), and $OUST ( ▲ 1.34% ) positions. I made additional position buys this week to $SOFI ( ▲ 1.69% ), $CHWY ( ▲ 0.8% ), and $OUST ( ▲ 1.34% ). Evolv Technologies had a solid earnings report for Q2 and raised revenue guidance for the year. Ouster announced a new BlueCity deal in Utah which pushed their rally this summer following Q2 earnings last week.

Portfolio News:

Evolv Technologies $EVLV ( ▼ 1.6% ) - Q2 Earnings

Revenue increased 29% YoY to $32.5M with annual recurring revenue growth also rising 27% to $110.5M YoY.

Reported a net loss of $40.5M, but adjusted EBITDA turned positive at $2M.

Operational cash flow improved from +$2.1M vs. –$21.6M YoY.

Revenue guidance raised was raised for FY25 now projecting $132–135M (27–30% growth).

$PLTR ( ▲ 3.91% ) - Palantir and SOMPO Expand Partnership in Multi-Year Agreement

$OUST ( ▲ 1.34% ) - Ouster BlueCity Expanding to Over 100 Intersections in Utah to Improve Roadway Safety and Congestion

$GOOGL ( ▲ 1.04% ) - Google Takes Stake In Bitcoin Miner As Part Of $3.7 Billion Deal

Freedom Fund Background: I launched the Freedom Fund in October 2022 as a public brokerage account to show that anyone—with just a bank account and Social Security number—can start investing, even with a couple hundred dollars a week. I started from $0 to make the journey real and relatable. Each week, I share transparent updates on purchases, sales, dividends, and growth on X (@GrahamSchroeder) so you can follow along in real time. The hardest part of investing is getting started—so I did, publicly, to help others do the same.

The purpose of this newsletter is to encourage you and our other 94 Gazette subscribers to start and stay consistent with your personal, professional, and financial journey.

Thanks for investing your time reading this.

-Graham (@GrahamInvesting)

Disclaimer: Graham’s Gazette provides information and resources related to investing, financial topics, and personal growth for educational and entertainment purposes only. The content presented is not intended to be construed as financial advice. Readers are encouraged to conduct their own research and consult with qualified professionals before making any financial decisions. Graham’s Gazette and its creators do not assume any responsibility for the accuracy or completeness of the information provided nor do they guarantee any specific results from such use of information.