- Graham's Gazette

- Posts

- #67 - New Position: Chewy $CHWY

#67 - New Position: Chewy $CHWY

Your home base for investing, finance, personal growth.

My Bet On Pets - Chewy, Inc.

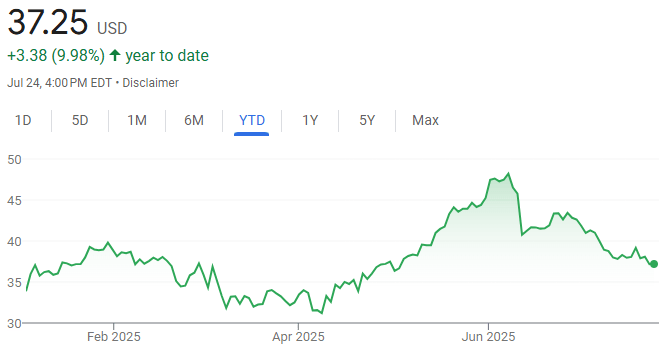

This week I bought a couple shares of $CHWY ( ▲ 2.28% ) to make my dog happy and potentially catch a nice swing play going into 2026. Chewy debuted at $22/share in June 2019 and then surged during the pandemic peaking at $118.69 in February 2021. As pet spending normalized, active customers declined in FY2022 and FY2023, dragging the stock ~85% from its highs to a low of $14.69. Until recently this year, their business seems to be gaining some traction.

Chewy has made a comeback in 2025, jumping over 150% and hitting in the upper $40’s last month. The rally was fueled by more customers, better profits, and strong subscription growth. Still, the stock has taken some hits… and I see an opportunity for a nice 3-6 month swing play and plan to start buying weekly over the next couple of months.

Revenue Growth - Q1 FY 2025 revenue reached $3.12 billion (+8.3% YoY).

Subscription Model - 82% of $CHWY ( ▲ 2.28% ) sales are now from Autoship orders with their auto‑delivery subscriptions. Autoship sales grew 14.8% in Q1. Growing recurring revenue business trends are what I like to look for.

Customer Growth - Active customers climbed to 20.8 million in Q1 FY 2025, a 3.8% YoY increase.

Margins - Gross margin rose from 28.3% to 29.6% YoY in Q1 FY 2025. Net margin dipped slightly from 2.3% to 2.0%.

Clinics - Chewy is expanding its vet clinic network, with 11 locations open and plans to launch 8–10 more by end of FY 2025, aiming for 100 clinics by 2030. This move taps into the $40B vet market, complementing its pharmacy, telehealth, and insurance offerings.

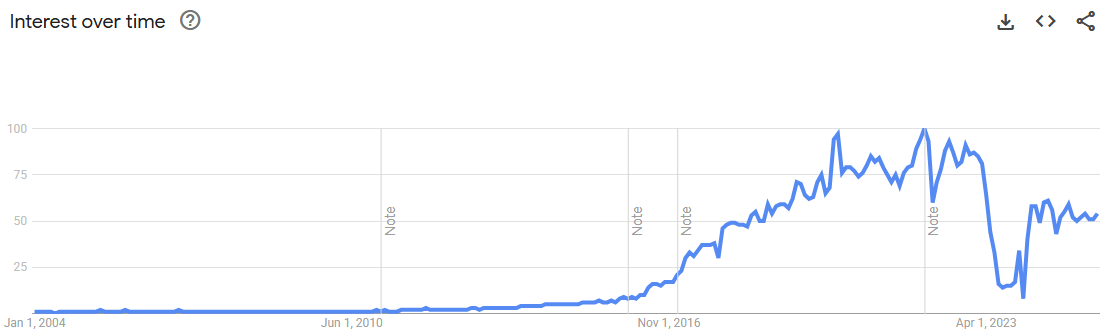

According to Google Trends, searches for “Chewy” surged in 2020–2021, peaking around Q4 2020 as pet adoption and e‑commerce use boomed. In 2023 search trends fizzled out, but since then it has recovered consistently since.

I also think about this from a social arbitrate play long term as well. As birth and marriage rates decline, especially among millennials and Gen Z, many are choosing pets over traditional family structures. Humans are still seeking companionship without the financial and emotional overhead of raising children.

Chewy could stand to benefit directly with its subscription-based pet ecosystem. And this aligns perfectly with this new reality of less people getting married and having kids. As more people channel disposable income toward pets instead of children, it could further push this growth story.

The company will release Q2 earnings sometime in September and I plan to buy more shares over time until we hear more of the recovery story. If this play doesn’t work out well in the short term… don’t blame me… blame the dog! 🤣

Find out why 1M+ professionals read Superhuman AI daily.

AI won't take over the world. People who know how to use AI will.

Here's how to stay ahead with AI:

Sign up for Superhuman AI. The AI newsletter read by 1M+ pros.

Master AI tools, tutorials, and news in just 3 minutes a day.

Become 10X more productive using AI.

Market & Freedom Fund Recap

U.S. markets pushed higher, with the S&P 500 reaching new record highs gaining about 0.6%, while the Nasdaq outpaced and the Dow ended slightly lower. Big Tech earnings, helped push sentiment despite weakness in small-cap stocks. Bitcoin hovered near $118,000. In a rare scene, Donald Trump and Fed Chair Jerome Powell toured the Federal Reserve’s renovation site, where they publicly disagreed over the project’s cost. Trump claimed it was $3.1 billion, while Powell corrected him, citing a $2.5 billion total. And what he was referring to was earlier already completed phases. Trump continued pressing for rate cuts but said he wouldn’t fire Powell. The cinema between rate cuts has been so entertaining. I can’t wait to see what happens when Powell finally decides to do a rate cut. June single-family housing starts dropped 4.6% month-over-month to an annualized rate of 883,000 units the lowest since early 2023. If single-family new home starts keep falling, it could tightens economic momentum going into 2026.

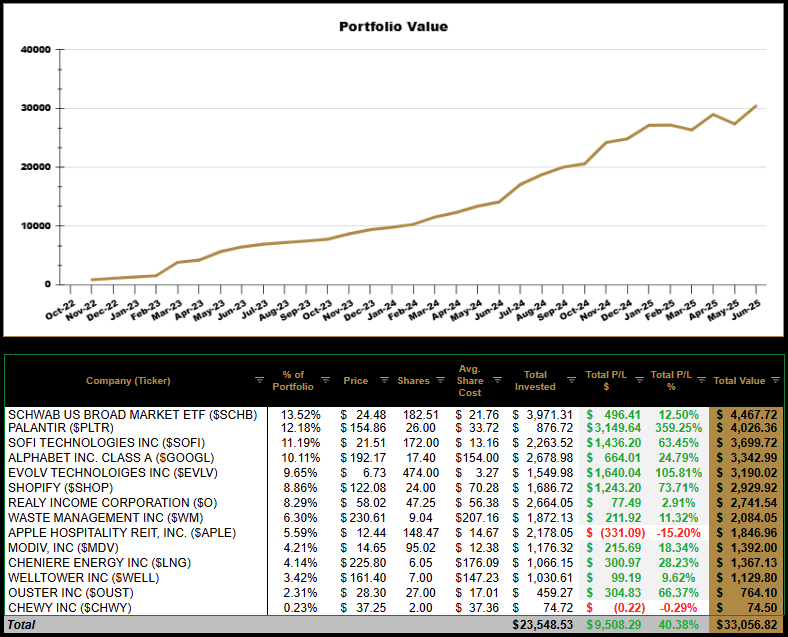

As of now, the public portfolio sits just over $33k up over $9,500 in unrealized profit.. The growth has been steady since October 2022, with a noticeable acceleration in 2024 mirroring market gains. Currently the fund is beating the S&P up 21.96% YTD (compared to 8.90%) year to date.

This week I added 4 shares of $SCHB ( ▲ 0.61% ) , 2 shares of $APLE ( ▲ 0.9% ) , and opened a tiny position into $CHWY ( ▲ 2.28% ) . The portfolio was boosted yet again by another +20% rise in $EVLV ( ▼ 7.37% ) , $GOOGL ( ▲ 4.01% ) trended up just shy of 4% after its earnings call, and $WELL ( ▲ 0.09% ) crossed the $160 mark.

Portfolio News:

Alphabet $GOOGL ( ▲ 4.01% ) Q2 2025 Earnings

Q2 FY2025 revenue rose 14 % year-over-year to $96.4 billion, with net income up 19% to $28.2 billion and EPS at $2.31, all exceeding analyst expectations

AI‑driven Search features helped Search & Other revenue climb ~12%, while YouTube ads surged ~13% to nearly $9.8 billion

Google Cloud revenue jumped 32% to $13.6 billion, boosting its annual run‑rate past $50 billion; operating income more than doubled, lifting both topline and margin strength.

Alphabet raised full‑year CapEx plan to $85 billion (from $75 billion), investing heavily in data centers and infrastructure.

Freedom Fund Background: I launched the Freedom Fund in October 2022 as a public brokerage account to show that anyone—with just a bank account and Social Security number—can start investing, even with a couple hundred dollars a week. I started from $0 to make the journey real and relatable. Each week, I share transparent updates on purchases, sales, dividends, and growth on X (@GrahamSchroeder) so you can follow along in real time. The hardest part of investing is getting started—so I did, publicly, to help others do the same.

The purpose of this newsletter is to encourage you and our other 94 Gazette subscribers to start and stay consistent with your personal, professional, and financial journey.

Thanks for investing your time reading this.

-Graham (@GrahamInvesting)

Disclaimer: Graham’s Gazette provides information and resources related to investing, financial topics, and personal growth for educational and entertainment purposes only. The content presented is not intended to be construed as financial advice. Readers are encouraged to conduct their own research and consult with qualified professionals before making any financial decisions. Graham’s Gazette and its creators do not assume any responsibility for the accuracy or completeness of the information provided nor do they guarantee any specific results from such use of information.