- Graham's Gazette

- Posts

- #66 - Trailblazer’s Creed

#66 - Trailblazer’s Creed

Your home base for investing, finance, personal growth.

The Unbeaten Strategy

John D. Rockefeller wasn’t just a business icon from our past, he understood the power of going against the grain. His advice to ditch the usual route and form your own still remains true, especially in a world where everyone seems to follow the same script. Whether you're launching a side hustle, navigating investments, or just finding your way, here are five key takeaways to help you break from the pack and build something uniquely yours.

Innovation > Imitation - Real growth stems from forming new ideas, not recycling old formulas. Whether you're investing in a niche or building a new skill, originality creates outsized value.

Risk is a Prerequisite for Reward - New paths involve uncertainty, but calculated risk is the gateway to returns that the average won’t touch. Embrace risk and don't retreat from it. If someone thinks it is too risky, you are probably on to something. Don’t shy away from exploring it in your own capacity. Risk doesn’t always need to be all in.

Conventional Wisdom Limits Potential - "Accepted success" often reflects outdated strategies. To lead your life to where you want it to go, you must think independently, even if it means being misunderstood.

Pioneers Build the Future - Those who venture into the unknown shape industries, set trends, and leave legacies. Following the herd may offer safety, but never legacy.

Self-Belief is Your Compass - New paths require conviction. Trusting your gut and process, even in the face of skepticism, is what separates visionaries from the average.

The next time you're tempted to play it safe, remember every breakthrough starts where the familiar ends. Your edge is in the path no one else sees yet.

Lean into what makes you different and be original. It is a copy cat league out there, and it can bring you initial success. Those who choose their original path will get the furthest.

AI Notetakers Are Quietly Leaking Risk. Audit Yours With This Checklist.

AI notetakers are becoming standard issue in meetings, but most teams haven’t vetted them properly.

✔️ Is AI trained on your data?

✔️ Where is the data stored?

✔️ Can admins control what gets recorded and shared?

This checklist from Fellow lays out the non-negotiables for secure AI in the workplace.

If your vendor can’t check all the boxes, you need to ask why.

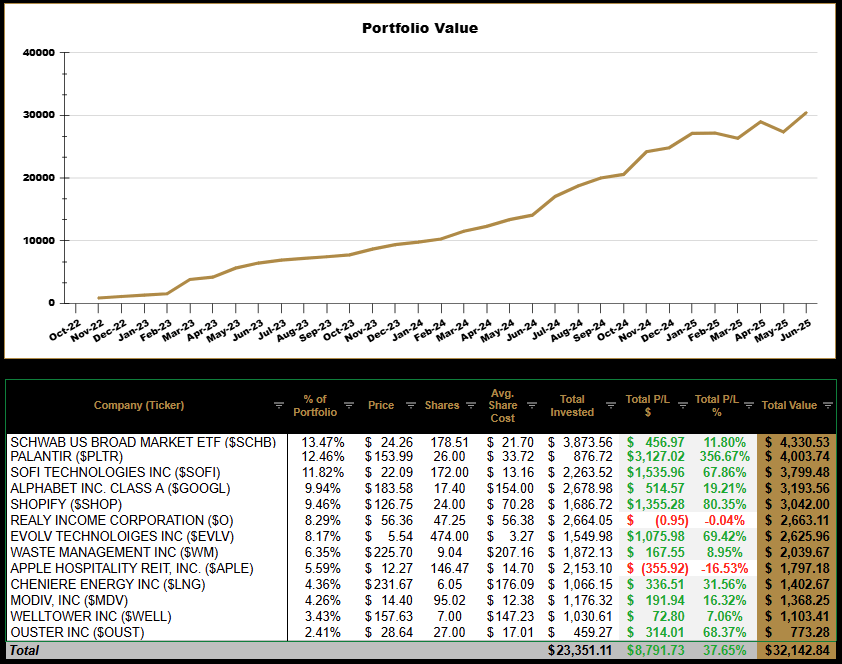

Market & Freedom Fund Recap

This week U.S. equities ended at record highs, with the S&P 500 $SPX ( ▲ 0.69% ) and Nasdaq $NASDAQ ( 0.0% ) hitting new peaks. The market was backed by by strong corporate earnings and a rise in June retail sales. The Dow also posted gains, climbing over 200 points after early week volatility linked to speculation about Fed leadership changes and potential new tariffs. Bitcoin $BTC.X ( ▲ 0.83% ) slipped slightly to around $119,000 after touching mid-week highs above $120,000. On the labor front, jobless claims dropped to 221,000 and June added 147,000 new jobs nearly half from the public sector. Data this week pointed to continued resilience in the job market despite trade uncertainties.

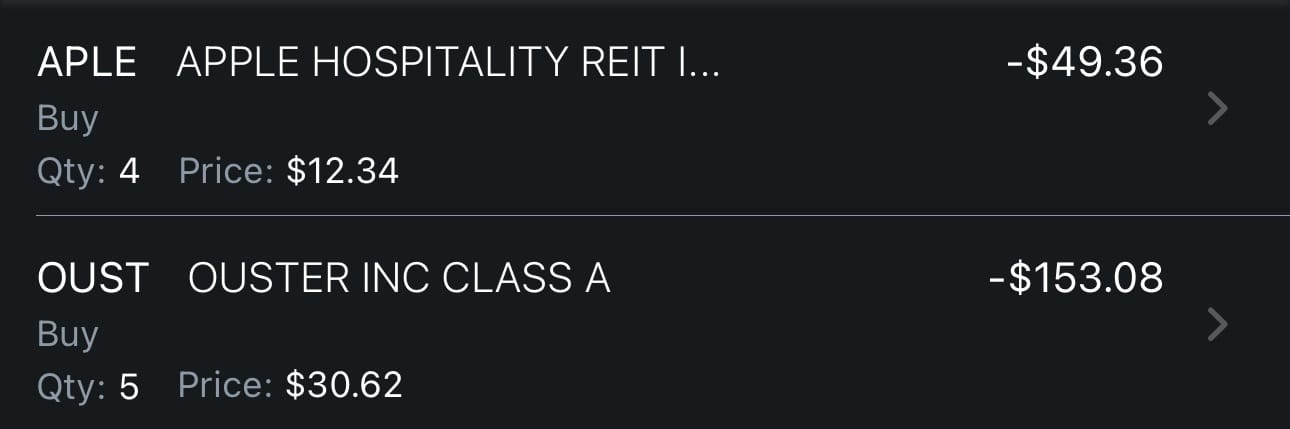

This week in the Freedom Fund I added 4 more shares of $APLE ( ▲ 0.9% ) Apple Hospitality and 5 more shares of $OUST ( ▼ 2.41% ) Ouster. Ouster topped the week off hitting over $30 a share at one point on Thursday notching up nearly 20% this week. Amidst the retail sales rise $SHOP ( ▲ 1.94% ) Shopify also was trading over 6% higher this week. Palantir $PLTR hit new all time highs of $155.68 as well.

With many companies in the portfolio reporting earnings in the near future I will plan to read and adjust as necessary. If the Ouster pump falls over in August and gives me a better buying opportunity I may start to buy more aggressively to build up my position more. I start to wonder how long this small cap wave will continue the rest of the year. With 13 positions in the portfolio I may add a couple others that I have been doing research on. However, it may be time to start trimming positions and taking profits as the early wave of A.I. starts to phase out.

Freedom Fund Background: I launched the Freedom Fund in October 2022 as a public brokerage account to show that anyone—with just a bank account and Social Security number—can start investing, even with a couple hundred dollars a week. I started from $0 to make the journey real and relatable. Each week, I share transparent updates on purchases, sales, dividends, and growth on X (@GrahamSchroeder) so you can follow along in real time. The hardest part of investing is getting started—so I did, publicly, to help others do the same.

The purpose of this newsletter is to encourage you and our other 94 Gazette subscribers to start and stay consistent with your personal, professional, and financial journey.

Thanks for investing your time reading this.

-Graham (@GrahamInvesting)

Disclaimer: Graham’s Gazette provides information and resources related to investing, financial topics, and personal growth for educational and entertainment purposes only. The content presented is not intended to be construed as financial advice. Readers are encouraged to conduct their own research and consult with qualified professionals before making any financial decisions. Graham’s Gazette and its creators do not assume any responsibility for the accuracy or completeness of the information provided nor do they guarantee any specific results from such use of information.