- Graham's Gazette

- Posts

- #65 - The Garage in Your Head

#65 - The Garage in Your Head

Your home base for investing, finance, personal growth.

Decluttering Your Mental Garage

"Our minds are like a garage. Cluttered with old excuses, fears, past failures. You have to take it all out and face the junk, sort it, fix the broken tools. Clean, organize, then maintain because daily discipline keeps the space functional.” - David Goggins

We all have a mental garage. Some keep it clean with tools on the wall, floor swept, and shelves stacked. Others? It's chaos. Boxes of shame stacked high. Old excuses leaking in the corner. Decaying regrets sitting where new ideas should be built. We need to think of our minds like a garage that must be organized.

A messy garage is the same as a a cluttered mind. Just like a garage filled with junk, tools you can't find, and old boxes you never open… your mind can get filled with regrets, trauma, excuses, and distractions. When it's messy, you can't be at your best.

Clean it up, item by item. You have to go into your mental garage and deal with each item by facing your past, confront your fears, point out your laziness, and stop hiding things in the corners. Having radical self realization will allow you to throw out the unnecessary.

Put things in their place. Once you've addressed your baggage, you need to create structure. Discipline, routines, priorities, and your clear goals go “on the shelves” where you can access them when needed.

Maintain it. Like a garage, if you stop organizing your mind, the clutter creeps back. Find ways to incorporate daily mental maintenance: journaling, physical suffering, reflection, and accountability.

When your mind is cluttered, you can’t find your grit. You can’t access your potential. You’re too busy tripping over the junk you’ve been avoiding. Your mind feeds the roots of your body. If its disorganized you won’t be able to handle the daily stressors, the adversity, the curveballs.

While I plan to actually clean out my garage this weekend. Take this as your weekly reminder to remove the scrap in your mind, organize the tools that make you special, and maintain the system you set up for yourself.

Get access to the most exclusive offers for private market investors

Looking to invest in real estate, private credit, pre-IPO venture or crypto? AIR Insiders get exclusive offers and perks from leading private market investing tools and platforms, like:

Up to $250 free from Percent

50% off tax and retirement planning from Carry

$50 of free stock from Public

A free subscription to Worth Magazine

$1000 off an annual subscription to DealSheet

and offers from CapitalPad, Groundfloor, Fundrise, Mogul, and more.

Just sign up for our 2-week free trial to experience all the benefits of being an AIR Insider.

Market & Freedom Fund Recap

Markets saw a mix this week with record-breaking rallies. The S&P 500 initially fell as tariff threats from President Trump hit investors, with major indexes declining on Monday. However, by Thursday, the S&P recovered to a record close of $6,280.46, helped by strong performances in airline stocks (Delta and United) and a surge in Kellogg shares following a takeover by Ferrero. Meanwhile, Bitcoin $BTC.X ( ▼ 4.47% ) soared to multiple all-time highs, breaking through $116,000. Nvidia $NVDA ( ▲ 1.02% ) reached a historic $4 trillion market cap. Traders now watch for further geopolitical developments and the Fed's response to tariff-driven inflation risks.

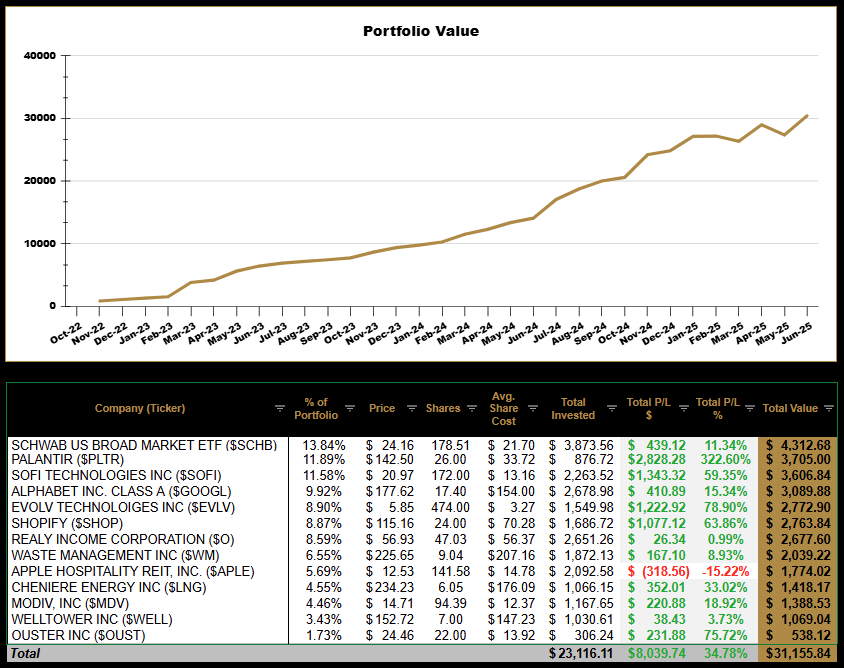

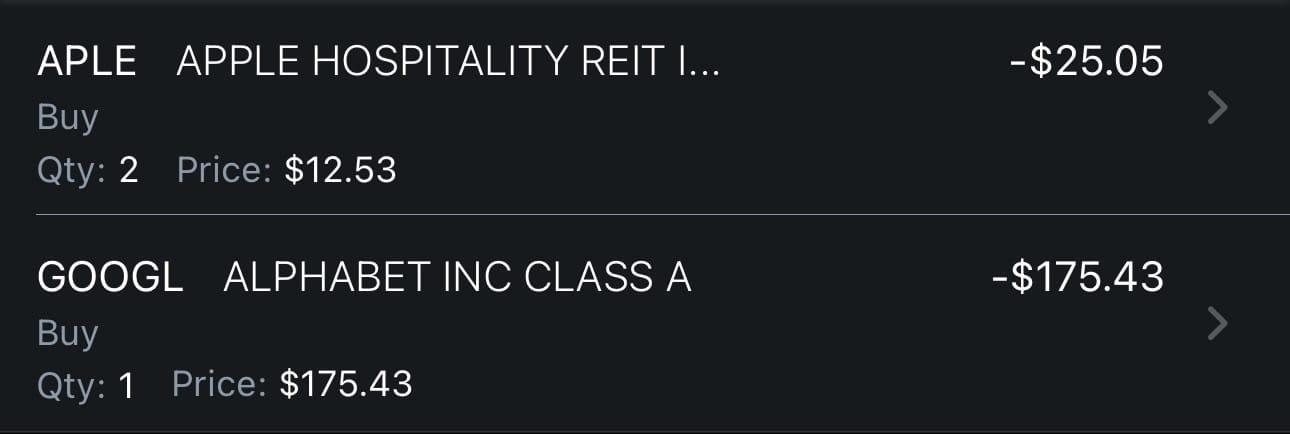

This week the Freedom Fund hit a new all time high matching the market. $SOFI ( ▼ 1.45% ) has continued to be on a tear now up over 14% this week. $OUST ( ▼ 2.41% ) has also rallied up another 12% this week and Q2 earnings call on August 7th. I decided to repeat last weeks purchases by adding another share of $GOOGL ( ▲ 4.01% ) and two additional shares into $APLE ( ▲ 0.9% ) .

I have a confession… I sold Teradyne $TER ( ▲ 2.83% ) too early and they are now starting to rise… it was just rumored that the robotic arms behind Amazon’s $AMZN ( ▲ 2.56% ) new warehouse robot, Vulcan, are reportedly being supplied by Teradyne. This could be a massive boost in backlog for Teradyne. This was another play that I should have trusted my gut being down 30% on the position and added more to average down. While I do have a modest position in a different account in $AMZN ( ▲ 2.56% ) , I think the robotics plays will outlive the A.I. hype in the coming years. If you don’t have a core position in robotics yet, there are still many plays out there that could be great bets 3-5 years from now. As of today, I plan to continue to build my $GOOGL ( ▲ 4.01% ) (Waymo), $AMZN ( ▲ 2.56% ) (warehouse robotics), and $OUST ( ▼ 2.41% ) (LiDAR tech) positions.

Last week, I mentioned $ACHR ( ▼ 4.15% ) (a holding I have in a different account) as a play that could begin to take off. Yesterday, Pete Hegseth announced a directive for the Pentagon’s procurement to start ramping up its arsenal of unmanned aerial systems. While Archer doesn’t make drones directly, they could benefit off of this initiative with the defense contracts for urban air mobility and logistics. The military is starting to flip its arsenal to a new wave of tech and I expect $ACHR ( ▼ 4.15% ) to benefit.

Portfolio News:

$PLTR ( ▲ 0.26% ) - Palantir and Tomorrow.io Partner to Operationalize Global Weather Intelligence and Agentic AI

$GOOGL ( ▲ 4.01% ) - Google adds image-to-video generation capability to Veo 3

$O ( ▲ 0.98% ) - Realty Income Announces 661st Consecutive Common Stock Monthly Dividend

$SHOP ( ▲ 1.94% ) - OpenAI Quietly Adds Shopify As A Shopping Search Partner

$EVLV ( ▼ 7.37% ) - Evolv Helps FIFA Club World Cup 2025™ Continue to Enhance the Fan Experience

Freedom Fund Background: I launched the Freedom Fund in October 2022 as a public brokerage account to show that anyone—with just a bank account and Social Security number—can start investing, even with a couple hundred dollars a week. I started from $0 to make the journey real and relatable. Each week, I share transparent updates on purchases, sales, dividends, and growth on X (@GrahamSchroeder) so you can follow along in real time. The hardest part of investing is getting started—so I did, publicly, to help others do the same.

The purpose of this newsletter is to encourage you and our other 94 Gazette subscribers to start and stay consistent with your personal, professional, and financial journey.

Thanks for investing your time reading this.

-Graham (@GrahamInvesting)

Disclaimer: Graham’s Gazette provides information and resources related to investing, financial topics, and personal growth for educational and entertainment purposes only. The content presented is not intended to be construed as financial advice. Readers are encouraged to conduct their own research and consult with qualified professionals before making any financial decisions. Graham’s Gazette and its creators do not assume any responsibility for the accuracy or completeness of the information provided nor do they guarantee any specific results from such use of information.